UAE is often considered as one of the fastest-growing countries of the world due to ample reasons. Investing in the country is a fruitful option for both expats as well as residents due to the positive business environment and liberal government policies. In our blog, we will further discuss the perks of investing in the United Arab Emirates and How to Invest in the UAE?

Why to Invest in UAE?

The key thing to clarify first is that Why should a person invest in the country?

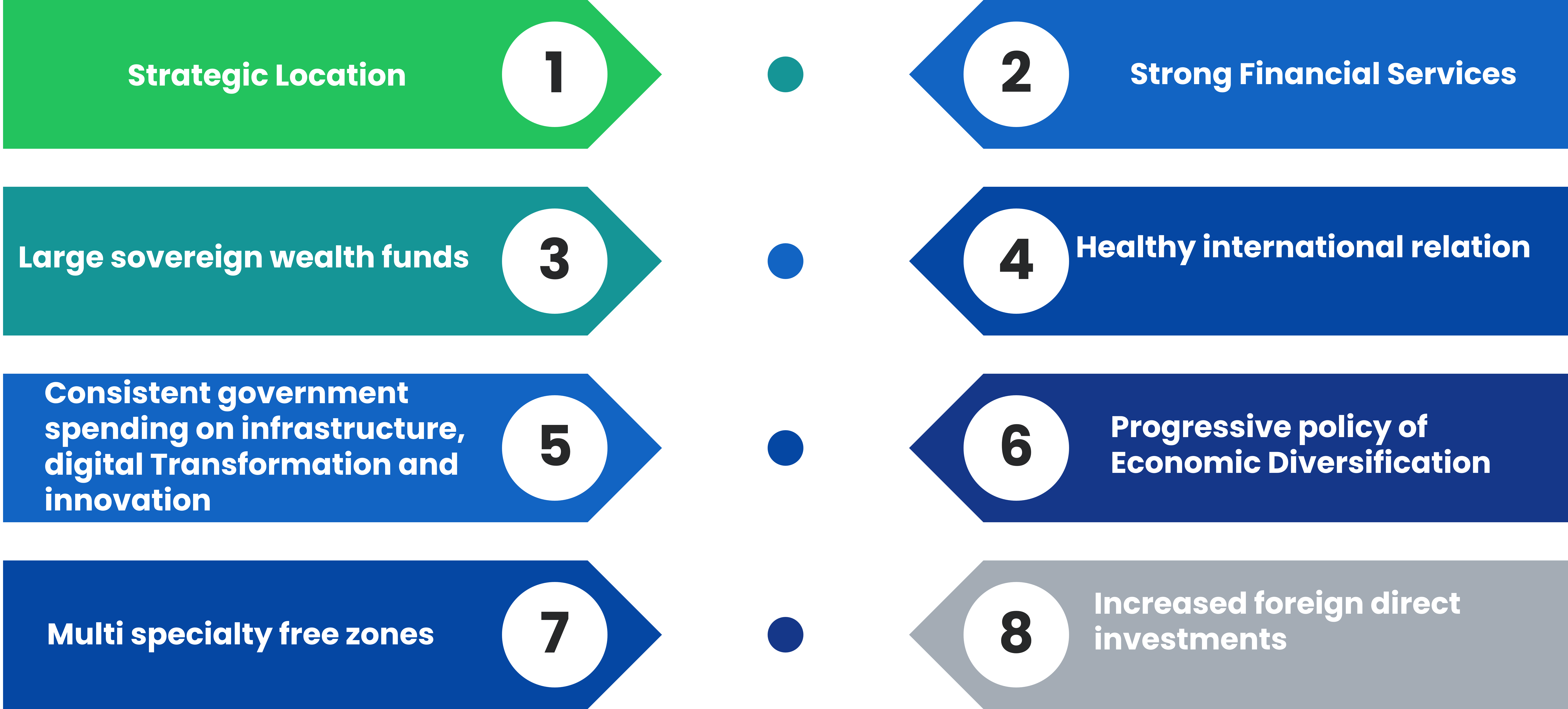

According to the Global Competitiveness Report 2019, the UAE is the 25th most competitive economy in the world, leading the MENA region, and is working to improve its position by diversifying its national revenue. The key factors that make UAE an ideal investment location further include:

- Strategic location

- Strong financial reserves

- Large sovereign wealth funds

- Healthy international relations

- Consistent government spending on infrastructure, digital transformation, and innovation

- The progressive policy of economic diversification

- Multi-specialty free zones

- Increased foreign direct investments (FDIs)

The United Arab Emirates has a favorable business climate. The UAE has an advantage over other countries due to its excellent infrastructure, professional competence, and personalized services. According to the World Bank's Ease of Doing Business Report 2020, the UAE is rated 16th in the world. Furthermore, The UAE allows businesses to conduct business from anywhere in the country. Free zones, industrial regions, and commercial buildings are among the options for venues. There are more than 40 free zones in the United States that allow businesses to be owned entirely by foreigners. In 122 economic activities in 13 sectors, mainland business legislation also enable 100 percent foreign ownership. The country also boasts cutting-edge industrial and commercial zones. High-profile conferences, international exhibits, and trade and investment events are also held there.

Moreover, investing in the UAE further gives lucrative incentives to the investors which are further given below:

- Up to 100 percent foreign ownership in free zones

- 100 percent foreign ownership in 122 economic activities across 13 sectors

- 100 percent profit repatriation

- An effective visa system allowing for the renewable of 10-year residence visa

- Competitive financing costs, high levels of liquidity, and a strong banking system

- No foreign exchange controls

- Strong appreciation and fully convertible currency

- Low inflation

- Low customs tariffs (between 0 and 5 percent for almost all goods).

Moreover, getting a resident visa on investing in the UAE has further attracted people from all over the world to shed their investment in businesses across the country. The UAE government has introduced a new immigration option for wealthy or highly qualified foreigners called the UAE Long-Term Residence Visa. This sort of visa is valid for 5-10 years, depending on the applicant's eligibility category. Furthermore, if you meet the requirements, you do not need a sponsor in the UAE to apply on your behalf; you can do it yourself.

The most common type of long-term residence visa issued is the UAE Investor Visa, which requires that the applicant invests a substantial amount of money in the UAE to qualify.

How to Apply for 10-Year UAE Residence Visa

If you fall into one of the following categories, you are eligible for a 10-year UAE long-term residence visa:

- You make a public-sector investment of at least AED 10 million

- You are a person with a specific talent, such as a doctor, scientist, inventor, specialist, or a person with a special talent in the sphere of culture and art; medical doctors, as well as computer, electronics, electrical, and biotechnology engineers.

How to Apply for 5-Year UAE Residence Visa

If you fall into one of the following categories, you are eligible for a 5-year UAE long-term residence visa:

- You purchase a property in the United Arab Emirates (UAE Investor Visa also known as the Property Visa UAE)

- You are a business owner with a project that requires a minimum investment of AED 500,000.

- You are an exceptional student who possesses the following qualities:

- In a public or private secondary school, a minimum grade of 95 percent is required.

- After you graduate online, you must have a GPA of at least 3.75 from a university within or outside the country, because information changes frequently. Before you apply or invest, be sure you have all of the information.

How to Invest in the UAE?

Furthermore, the debate comes to a point where a decision must be taken based on the investment to be made based on the following critical elements. Expats and non-resident foreigners can take advantage of a variety of investment opportunities in the region. Furthermore, the law provides adequate protection for UAE investments.

When it comes to investing in the United Arab Emirates, this handy guide has all you need to know on How to Invest in UAE?

- Investment can be made in either a freezone or on the mainland.

- The type of business sector in which to invest.

- The type of trade license that has been chosen.

- Types of Businesses to Invest In (Sole Proprietorship, Civil Company, Branch of Foreign Company, Partnership Firm, LLP)

- Examine your long- and short-term goals, as well as your timeline and risk-bearing capacity.

- Look for financial instruments that meet your risk tolerance while also assisting you in achieving your goals.

- Compare different investment vehicles based on a variety of parameters like investment expense, time duration, risk level, and so on.

- Avoid investing in vehicles that provide large returns but also carry a high amount of risk, as there is a chance the investor will lose money.

Conclusion

Looking forward to investing in the UAE, connect with Dhanguard for assistance. Our expert business setup team will guide you through the paperwork, obtaining of licenses, and arrangement of corporate bank accounts for you. Our team will further provide you assistance from the start of the process to its end. If you want any services related to business setup, connect with us, we will gladly assist you.