Get FREE CONSULTATION with our team of experts! Click here to start!

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Opening a personal bank account in the UAE is a simple procedure that requires minimal documentation. For those who have never dealt with such processes in the UAE, however, the process of opening a personal account in the UAE can seem complex and time-consuming. Our experts' experience helps them to deal with the process of opening a personal bank account in the UAE in a timely manner, while their expertise and ongoing work with various clients has left all pertinent details at their fingertips.

The UAE has a world-class banking system that is recognised for its outstanding customer service and economic stability. Many wealthy entrepreneurs and international investors want to open a bank account in the United Arab Emirates. Anyone who meets the legal requirements can open a personal bank account in the UAE. Dhanguard provides comprehensive details on the conditions and paperwork required to open a personal bank account in the United Arab Emirates.

Of course, having a bank account in the UAE is not a legal requirement. However, there are a number of reasons why getting one is advantageous. Accountholders are usually able to better control their spending and saving patterns. Regularly received bank statements show where and when the funds were spent. This will assist people with budgeting and long-term planning.

The need of personal account in UAE are as follows-

There must be individuals who have attempted to pay their large bills in cash rather than using the services provided by a bank account. Making payments in this manner can be difficult at times. The ability to simply write a cheque can be a big relief for those who previously had to rely on money orders or wire transfers.

The ability to open a bank account online has become very easy in recent years. Other services provided by banks include person-to-person payments, online direct transfers between accounts, and 24-hour account access, all of which have aided in making users' lives easier.

People used to hide their money under their mattresses in the past. Gone are the days when a mattress might keep your money secure. This personal fortune can be stripped away in a moment by a robbery or a house fire. There is, however, a safer choice. People can deposit their funds safely with the bank by opening a personal bank account in Dubai. Banks have safeguards in place to protect deposits, ensuring that if anything were to happen to the bank, the deposited funds would not be lost.

People get a certain amount of interest on their deposits when they put their money in bank accounts. The accountholder will regard the interest received on the deposits as a source of income. It inspires them to save on a regular basis, which is unquestionably a healthy habit to start at a young age.

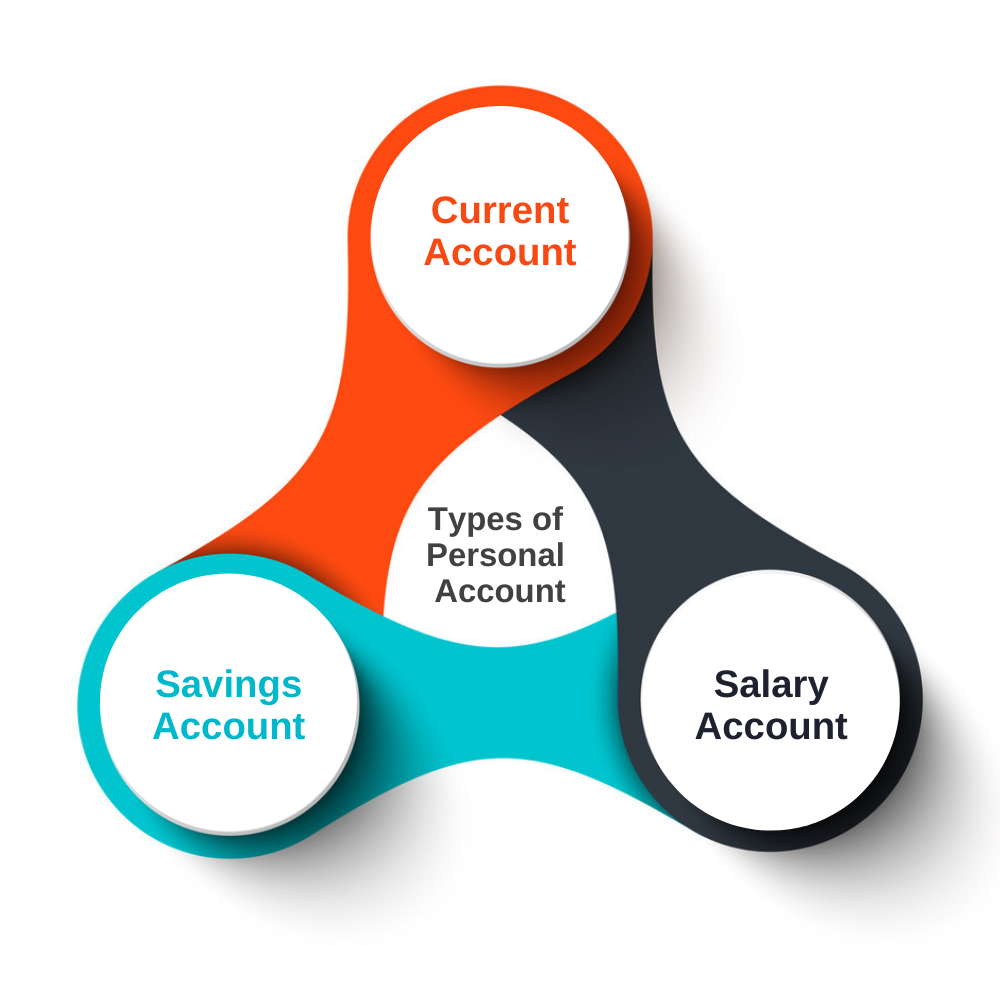

Types of Personal Account in UAE are as follows-

Savings accounts are deposit accounts with a bank or financial institution that pay a low rate of interest to the accountholder (profit rates in case of Islamic Banks). The number of withdrawals from a savings account each month can be limited at the discretion of the bank or financial institution.

In the case of a savings account, the accountholder is required to maintain a monthly average balance in the account. If the account is a zero balance account in the UAE, however, this is not necessary. If they do not uphold this minimum balance, they will be paid a penalty. Savings Account can be opening as a Salary Account, Non- Salary Account, Digital Account as well as Non-Resident Account.

How does Savings Account work?

Savings accounts are often used to store funds that are not intended for routine or daily expenditures. The amount of deposits and withdrawals an accountholder may make in a month may be limited. On this deposit, accountholders receive a large amount of interest (profit rate).

What are the benefits of keeping a Savings Account?

The benefits of having a savings account in the UAE are numerous. Here are a few of the benefits.

Firms, businesses, businessmen, and public enterprises that have a high volume of daily transactions with financial institutions or banks choose to open a current bank account in the UAE.

Withdrawals, investments, and contra transfers are all part of the current account. The amount of purchases that can be made in a month is usually infinite for these accounts.

A salary account is a bank account into which your pay is deposited. Banks in the UAE usually open such accounts at the request of large corporations or major corporations. Employees of the firms are given their own salary account, which they can handle on their own.

Bank accounts in the UAE come with a variety of enticing benefits and features. Mentioned below are a few of them.

Most banks in the UAE have free debit/credit cards in addition to bank accounts. These cards are used by account holders to access their funds. They can also make withdrawals, but only up to the cap set by the bank in question.

Many banks in the UAE give account holders the option of using a chequebook to make transactions easier.

The account holder can convenintly move funds from their bank account using the concerned bank's net banking or mobile banking services.

If the accountholder has a bank account with any bank in the UAE, they can easily obtain business, personal, vehicle, and other types of loans.

The banks in the United Arab Emirates offer competitive interest rates on deposits (profit rates in the case of Islamic banks). This interest is a source of income for the accountholder and can be used to save money.

Accountholders in UAE banks and financial institutions have access to customer support 24 hours a day, 7 days a week. They are effective in resolving their problems and inquiries.

AED 3000 or equivalent is the minimum monthly average balance required for Personal Account in UAE.

Requirements for Personal Account differ by bank, just as they do with savings accounts, but the following are the basic documents required to open a bank account: your passport (original and copy) with your UAE residency visa; your Emirates ID card (original and copy)

Customers who open an account for salary transfers must have a salary transfer letter as additional documentation.