Get FREE CONSULTATION with our team of experts! Click here to start!

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

A Salary Account is opened to credit the monthly salary of the employees in any company. This Account is opened upon the request of major companies and corporations. Each employee gets their own salary account to be operated and use as they deem fit. Meanwhile, when the time comes to pay the salary, the bank credits the salary to the employees’ account from the company’s account. Account holders should note that whenever a Salary Account is not used for a specific period of time, it is converted to Savings Account. Similarly, most salary accounts in the UAE does not offer profit rates on deposits as well as savings.

Salary accounts have very low or no necessities for minimum balance. These accounts also make the payment for utility bills with ease & convenience. Some salary account can also have Joint account holders. Though, the applicants for the Joint Account will require identification proofs. Salary account holders obtain additional benefits such as easy loan approval, credit cards and many more.

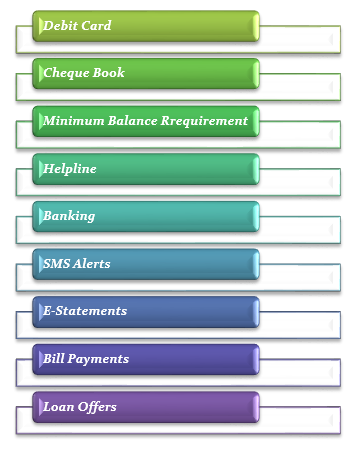

Some of the features and benefits of the Salary Accounts in UAE are as follows-

A debit card is available with all the salary account in the UAE. Moreover, the debit card can be used internationally.

A Cheque Book is accessible for free with the Salary Transfer account.

With the salary transfer account, there is no obligation for the minimum monthly balance.

The customer support team is available 24x7.

Free banking through Online Banking and Mobile Banking.

Customers get SMS alerts for any activity occurred in the account.

E-statements are free with the Salary account.

The salary account can also be used for bill payments like to pay the utility bills and so on.

As a Salary Account holder, the customers can also apply for a loan easily with the concerned Bank.

Some of the basic requirements to open a Salary Account in the UAE are as follows-

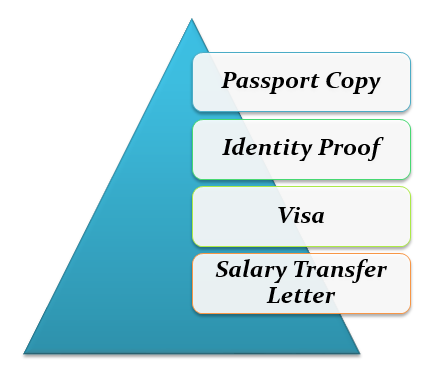

The required documents to open a Salary Account in the UAE are as follows:

The Applicant needs to submit a copy of their Passport to the concerned bank.

The applicants need to submit a copy of their Emirates Identification Card to the concerned bank.

The applicant needs to submit their Resident Visa to the concerned.

The applicant needs to submit a copy of Salary Transfer Letter to the concerned Bank.

To open a Salary Transfer Account with the banks in the UAE, you can submit any of the following documents as proof of salary such as Salary Transfer Letter, Salary Certificate, Pay Slip, Print out of MOL or Labour Certificate or Offer Letter. But it is always advisable to submit your Salary Certificate to the concerned bank as a proof of your salary.

Any individual who meets the necessities of the bank is eligible to open a Salary account in UAE. There is no limit of initial deposit required to open a salary account at most of the banks or financial institutions in UAE. The account opening process is as follows-

The minimum salary requirements differ from bank to bank. Though, most banks require a minimum salary of AED 5000 to open a salary account in the UAE.

To close the Salary Account in the UAE, the client will have to visit the nearest branch of the concerned bank.

No. It is not essential to be an existing customer of the bank to open a Salary Account in the UAE.

Yes, an emigrant can open a Salary Account in the UAE. Though, he or she will have to be a resident of the UAE.

That would depend on the bank in which you have the Salary Account with. Some banks require a monthly balance to be maintained while some banks don’t require.

Yes, some banks in the UAE will open a salary account for the client with a salary of AED 3000 per month.