Get FREE CONSULTATION with our team of experts! Click here to start!

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Despite the fact that there are comparatively few companies offering Life Insurance products. Dhanguard could help you to connect with the best. Connect with us and let our expert guidance assist you in choosing the right product for yourself.

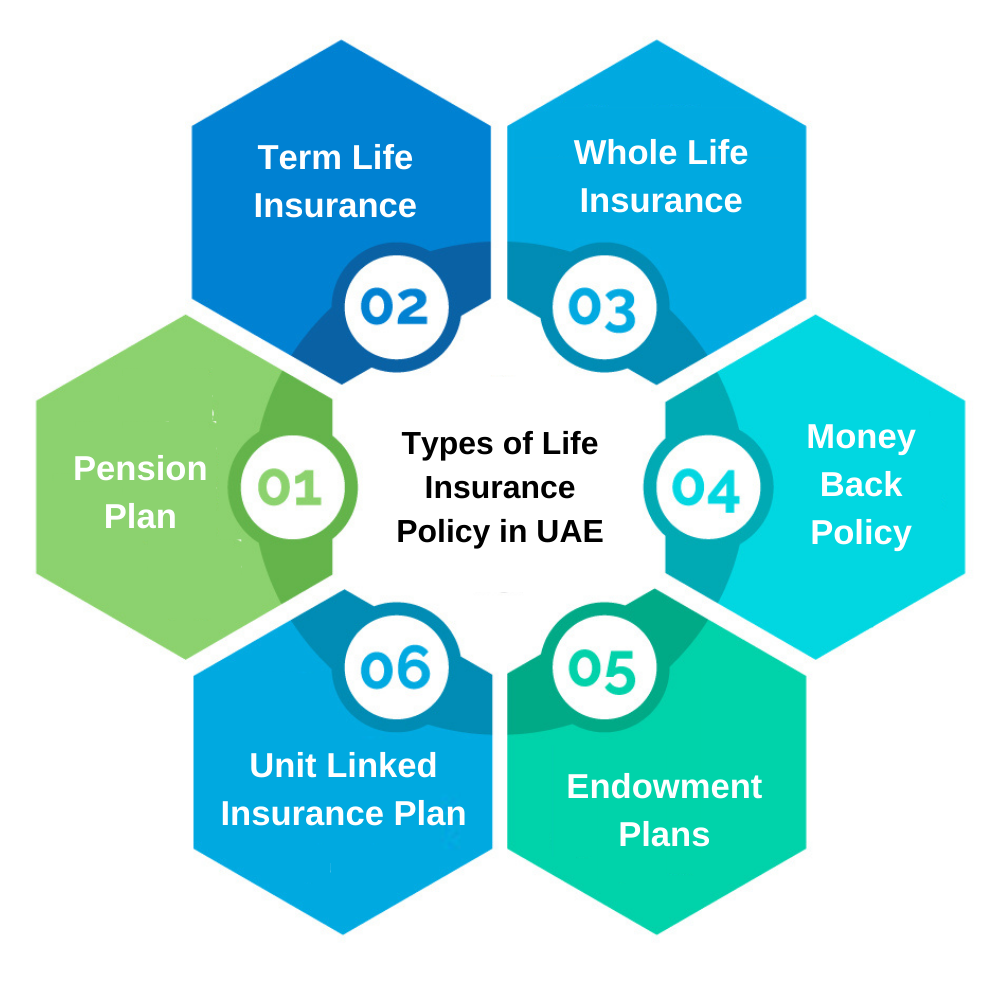

Types of Life Insurance Policies in the UAE:

In the United Arab Emirates, there are a few life insurance firms that sell a wide variety of life insurance products, including endowment policies, term plans, whole life insurance, ULIPs, and so on. Premium rates for life insurance in the UAE differ depending on the applicant's age, medical background, amount guaranteed, wages, and a number of other variables.

According to a survey, nearly 51% of UAE residents do not have a life insurance policy, 36% believe it is too costly, and the rest are unfamiliar with the word. An adequate life insurance policy, on the other hand, will help to fill some of this void, guaranteeing the financial stability of the insured's family. In the United Arab Emirates, life insurance has yet to gain prominence.

Life insurance is an arrangement between a policyholder and an insurance broker in which the insurer or insurance company agrees to pay a defined amount of a death benefit to the beneficiary if the policyholder dies suddenly during the policy's period.

In exchange, the insured offers to pay a set amount of money as a daily premium, a restricted premium, or a one-time premium. One can guarantee the financial stability and welfare of their family's future by buying sufficient life insurance coverage.

The following are the measures involved in life insurance in Abu Dhabi and the UAE:

Step 1: The policyholder pays the insurance firm the required premium.

Step 2: In the event of the policyholder's untimely death during the policy duration, an insurance provider guarantees to pay an amount guaranteed to the beneficiary. As a result, it guarantees the policyholder's a financial security.

Step 3: If the life insured survives to maturity, the policyholder will receive a maturity advantage. However, it is dependent on the category of policy and whether or not it provides maturity benefits.

There are variety of Life Insurance Policy in UAE, some of them are explained below-

Term insurance is the most common and cost-effective form of life insurance policy, providing financial protection to the insured for a set period of time. A death benefit will be paid to the beneficiary if the life assured dies during the term span when the scheme is active.

A whole life insurance policy covers the policyholder for the rest of his or her life. The sum guaranteed is paid to the beneficiary in the event of the insured's untimely death. This form of life insurance policy, in addition to providing a death benefit, also provides an investment feature that builds up a cash value that policyholders can withdraw or borrow as needed.

Endowment policies are a form of life insurance policy that not only offers coverage in the event of the policyholder's sudden death, but also provides maturity benefits at the policy's end.

The Unit Linked Insurance Plan, also known as ULIP, is a mix of insurance and investment. The money invested is split into two parts since it is a hybrid scheme. A portion of the premium is used to secure your health, while the remainder is invested in the stock market to ensure future income.

The policyholder earns a percentage of the amount guaranteed at regular intervals over the lifetime of the policy in this form of life insurance policy. An insured receives the balance of the sum guaranteed if he or she survives the term. However, regardless of how many instalments have been paid out, the candidate retains the whole amount assured in the event of death during the plan's term.

This life insurance policy, also known as a retirement plan, guarantees a financially stable retirement by providing a monthly income as an annuity payout, depending on the form of policy selected. This balance will be accumulated at maturity to produce a daily income stream, which is known as an annuity or pension.

The benefits of Life Insurance Policy in UAE are as follows-

The life insurance company provides coverage in the form of a death benefit if the policyholder dies during the policy's term, resulting in a loss of income for the policyholder's family.

Life insurance plans include a predetermined sum insured amount, which is paid to the survivors by the insurance company upon the policyholder's death.

Critical disease and hospitalization costs are also covered by life insurance plans. In the event of a disability or a diagnosis of a disease, a life insurance policy requires you to pursue appropriate care.

Purchasing the right life insurance policy offers peace of mind, ensuring that in the case of an unexpected event, the safety of one's loved ones will be taken care of.

There are several life insurance policies on the market that provide both coverage and investment opportunities. The policyholder's premium is dissected and used to provide coverage and investment incentives.

Many life insurance policies in the UAE provide add-on riders such as temporary/permanent disability coverage, serious illness coverage, terminal illness coverage, waiver of premium value, personal accidental coverage, and so on, which are supplementary coverage over the standard plans that are normally purchased with the intention of expanding the plan's protection.

The following are some of the basic conditions for life insurance firms in the United Arab Emirates:

Sum assured is the assured amount that the policyholder will receive. It is also known as the coverage amount for which an individual is insured.

There are a variety of life insurance plans available in the UAE to fit any budget and financial condition. Thus, in order to find the right life insurance policy, it is best to browse around and compare various life insurance quotes online based on coverage, features, and price.

The length of a life insurance policy, on the other hand, cannot be changed after it has been given to you.

Since term insurance has no maturity, you will not receive anything. The death benefit is the only benefit you can receive under this package. In the event of the policyholder's untimely demise, the beneficiaries would collect the amount guaranteed.