International health insurance, often known as International Medical Insurance, is a type of insurance that covers medical expenses incurred while travelling to another country. When travelling or relocating to another country for an extended period of time, international health insurance ensures that you obtain the best medical care possible, regardless of your financial situation or location.

International Medical Insurance Plan Types

In the UAE, international insurance providers offer a variety of plans to cover your medical requirements while you are away from home. There are Four types of international health insurance plans in general:

International Health Insurance Plan for Individuals

This plan is best for persons who are travelling abroad for business, work, or pleasure. This plan, which covers one person, assures that even if you are alone in a foreign country, you will be covered by international insurance in the event of a medical emergency.

International Health Insurance Plan for Families

Family international medical insurance plans are your best bet if you're travelling to a foreign country with your family and expect to stay for a few months or years. It covers all family members' medical bills, giving you full protection at an affordable cost. All you have to do is disclose all of your family members' information before deciding on the premiums to be paid. Premiums may differ depending on the age and health of your family members.

International Student Health Insurance Plan

Students pursuing higher education in a foreign nation account for the largest number of travelers travelling from one country to another for an extended period of time. For students, this form of insurance coverage covers health care, routine check-ups, and emergencies.

International Health Insurance Plan for Corporations

Employers in the United Arab Emirates are required by law to provide health insurance coverage to their employees. If you're a company looking to get insurance for your foreign workers, this policy will save you a lot of money.

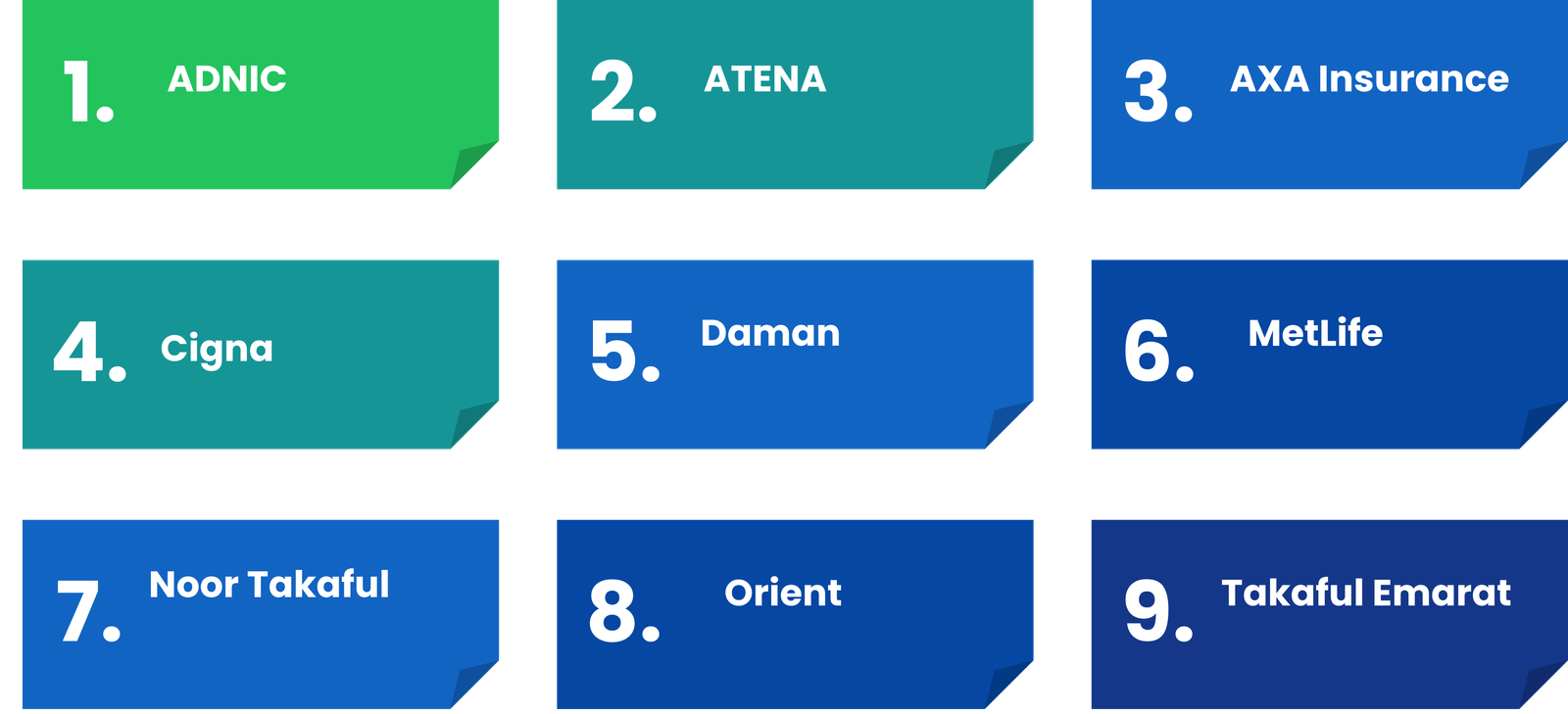

Dubai's Top International Health Insurance Companies

Many prominent firms in the UAE offer foreign medical insurance at a reasonable price and with the highest level of customer satisfaction.

ADNIC

The Abu Dhabi National Insurance Company has joined with MSH has offices in North America, South America, Europe, Africa, the Middle East, and Asia, providing 24/7 support in 60 countries and online health information in over 150 countries.

AETNA

Aetna is the second largest insurance company in the United States.

Aetna International provides complete outpatient treatment of up to 90 days and rehabilitation of up to 120 days to meet your medical needs, including emergency maternity care, dental care, and optical care. It is one of the world's best multinational health insurance firms.

AXA Insurance

AXA's global healthcare plan is one of the top medical insurance alternatives available everywhere in the globe. With affordable prices, AXA also allows you to customize your insurance plans to meet your specific needs, eliminating the need to purchase an annual policy. You can take advantage of the company's short-term plan.

Cigna

Cigna, based in Europe, offers one of the largest health-care networks in the world, allowing you to choose your own health-care provider. Furthermore, Cigna provides multilingual support 24 hours a day, 7 days a week, ensuring that communication while away from home is never a problem.

Daman

Daman gives you some of the top insurance policies for your medical needs by partnering with over 18000 international health care providers across the world. Daman is also a suitable alternative for overseas insurance buyers due to the high settlement claim.

Metlife

Metlife is a financial services company.

Metlife offers worldwide mobility solutions that cover medical treatment costs all over the world. Customers can create their own plans, choose a short-term plan, or select one of the company's pre-designed plans. You can construct your own plan from the wide variety of options available.

Noor Takaful

Noor Takaful, which was founded in the United Arab Emirates in 2009, has partnered with various foreign health care providers to spread their medical insurance programmes around the world. The company's world-class international partners ensure that you receive world-class service all over the world

Orient

Orient has partnered with Allianz Care to deliver you the best international medical insurance policies that cover your medical requirements anywhere in the world. Along with its normal core plan, the organisation gives the option of adding optical and dental coverage to provide you with the best possible protection.

Takaful Emarat

Takaful Emarat's global policy provides worldwide coverage with superior health plans that include dental and optical benefits, home nursing, and complimentary physiotherapy. Takaful Emarat global coverage is one of the best foreign insurance plans in the UAE, with premiums starting at just AED 5 per day.

What Are Your Options for Finding the Best International Medical Insurance Company?

All of the aforementioned organizations are among the top international insurance companies in the UAE, making it tough to choose one. Here are some pointers to assist you in selecting the best insurance:

- Examine your requirements.

- Examine the premiums.

- Examine the success rate of claim settlement.

- Consider the company's health-care partners.

- Covered areas.

Conclusion

The UAE government is dedicated to establishing a world-class health system in order to improve the quality of healthcare and health outcomes for its citizens. In order to do this, it has implemented substantial health-care reforms over the last decade, including the introduction of mandatory private health insurance, the growth of the private sector, and the separation of planning and regulatory activities from provider roles. Although there are some encouraging indicators such as high patient satisfaction, expanding JCI accreditation coverage, and isolated cases of quality improvement, it is impossible to evaluate if the reforms are succeeding based on the existing research literature. We believe that study in this field should continue, but that research topics should be more precisely defined, with an emphasis on results whenever possible compared to procedures

Furthermore, better data collection and reporting are required to identify the health needs and outcomes of certain population sub-groups. Finally, there is room to align services and programmes closer to worldwide best practice, as well as to compare UAE performance to that of other highly developed, progressive health systems around the world.