Get FREE CONSULTATION with our team of experts! Click here to start!

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Bank Street Road,Burjuman,Dubai,UAE

Mon-Sat 9am-6pm

24 X 7 online support

Talk to our Expert

Ajman Mainland, located in the United Arab Emirates (UAE), has various benefits for company establishment. Despite its modest size, business setup in Ajman offers a booming business climate and is a popular choice for many entrepreneurs. Its strategic position and easy accessibility make it an appealing choice.

Ajman Mainland is located on the Arabian Gulf coast and shares borders with Umm Al Quwain and Sharjah, making it convenient for key commercial centres in the UAE. Because of its ideal position, firms may readily interact with suppliers, clients, and partners in neighbouring emirates.

The Mainland of Ajman is home to various industries that attract businesses. Real estate, retail, construction, transportation, and business services are some of the most common business sectors. These industries provide several opportunities for growth and development, aided by the emirate's solid infrastructure and business-friendly regulations.

Business setup in Ajman Mainland is recognised for being a simple and quick procedure. Getting guidance from specialists familiar with the UAE's company establishment processes is advised to guarantee a smooth experience. Dhanguard has extensive expertise enabling company establishment in the UAE and can help throughout the whole process, assuring your firm's seamless and successful business setup in Ajman Mainland.

There are various compelling reasons for entrepreneurs to establish a firm in Ajman, UAE. Here are some of the main advantages of business setup in Ajman:

Ajman's strategic location on the Arabian Gulf coast allows easy access to key markets in the UAE and around the region. Because of its closeness to Dubai and Sharjah, firms may connect to their economic networks and reach a vast consumer base. Furthermore, Ajman's proximity to international airports and seaports promotes efficient import-export operations.

Ajman provides a welcoming environment for businesses with investor-friendly legislation and regulations. The emirate has implemented programmes encouraging and promoting entrepreneurship, making it an excellent location for startups and small enterprises. The government's dedication to economic diversification and long-term growth creates a stable and favourable business environment.

Ajman has low startup and operating expenses compared to other emirates in the UAE. The cost of living, office leases, and labour are all relatively low, allowing firms to cut costs while increasing profits. Ajman's low cost of doing business makes it an appealing option for companies wishing to establish a presence in the UAE.

Ajman has state-of-the-art infrastructure and facilities to facilitate commercial activities. The emirate provides the infrastructure for businesses to succeed, from well-connected road networks and contemporary office spaces to innovative telecommunications systems. The availability of renewable energy options and eco-friendly activities demonstrates Ajman's dedication to sustainable development.

Real estate, retail, construction, manufacturing, logistics, and services are among the sectors found in Ajman. The emirate's emphasis on economic diversification and innovation has aided the expansion of these sectors, creating several chances for enterprises to thrive and expand.

The government of Ajman actively promotes enterprises through a variety of measures, including business development programmes, incentives, and expedited processes. These efforts seek to expedite business formation, encourage investment, and assist entrepreneurs. The government's dedication to cultivating a thriving business ecosystem improves the chances of success for Ajman firms.

In summary, Ajman provides a strategic position, a business-friendly climate, cost-effectiveness, a solid infrastructure, and helpful government activities. These features make it an intriguing alternative for entrepreneurs wishing to establish a firm in the UAE, as it provides a stable platform for development and success.

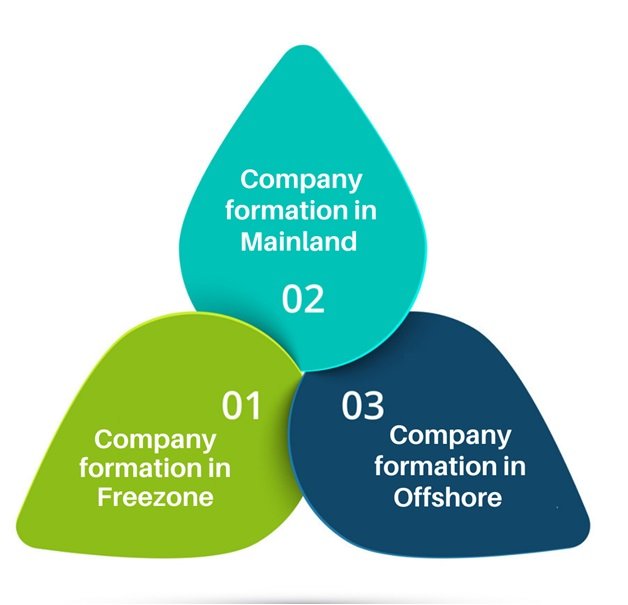

Ajman, UAE entrepreneurs have three primary alternatives when establishing a business: Mainland, Offshore, and Free Zone. Depending on the nature of the business and the individual needs of the entrepreneur, each choice has its own set of benefits and considerations. Let us examine each possibility in further detail:

Businesses in the Mainland of Ajman can operate anywhere in the emirate. Establishing a business on the Mainland allows you access to the local market and potential consumers. It also allows you to trade directly with the UAE market and the larger GCC area. Mainland enterprises are not restricted to certain activities and can operate in various industries.

Ajman Offshore is a popular alternative for companies primarily dealing in international trading or investing. Tax benefits and anonymity are available to offshore enterprises in Ajman. They are not needed to establish a physical office in the UAE and are free to keep assets and do business outside the nation. Offshore companies provide flexibility and are appropriate for firms that do not need a physical presence in the UAE but wish to take advantage of the country's strong legal and financial environment.

Ajman Free Zone offers a welcoming atmosphere for businesses and several incentives and perks. Free zones are intended to attract foreign investment, boost commerce, and ease corporate operations. Establishing a business in a free zone provides benefits such as 100% foreign ownership, reduced tax rates, and streamlined customs processes. Free zones also give access to cutting-edge infrastructure and business support services, making them especially appealing to enterprises involved in trading, manufacturing, logistics, and other speciality industries.

Finally, the decision on where to do company formation in Ajman is influenced by criteria such as the nature of the firm, target market, preferred ownership structure, and industry-specific needs. Consulting with business setup professionals such as Dhanguard can give helpful information and assist entrepreneurs in making educated decisions based on their specific requirements and objectives.

The rapidity with which Ajman Mainland Business Setup is well-known. The operation is made easier with the help of Dhanguard experts! Various steps and substantial documents are required for company Registration in Ajman. Dhanguard will walk you through the process to guarantee no stumbling blocks. Here are the steps for Ajman business setup:

The first step in starting a company is to file a company application. This must be done through the municipality's customer service centre.

Following that, you must follow up with the Inspection Unit of the municipality of Ajman to confirm the business location. Depending on your business activity, you may need authorization from other departments.

You must receive permission to use the trade name. Following approval, you must get the business registration and membership certificate.

After everything is authorised, you must submit the information and receipts from the Ministry of Trade to be accepted into the Register of Companies.

You must pay all applicable fees and apply to the Customer Service Centre. The next day, you will receive your business licence.

Dhanguard is a good option for entrepreneurs seeking company setup in Ajman, UAE. They can negotiate the complicated environment of company rules in the UAE since they are thoroughly aware of the legal requirements involved. Dhanguard guarantees that clients obtain accurate and up-to-date information by remaining current with the ever-changing business norms and regulations, allowing them to make educated decisions for their company operations.

One of the most notable benefits of working with Dhanguard is their commitment to a simple registration procedure. Their knowledge and experience in business setup enable them to expedite the essential procedures, saving their clients important time and effort. Furthermore, their efficient approach results in cost savings because they optimise resources and guarantee that the business setup process is carried out cost-effectively.

Entrepreneurs may have peace of mind knowing they are in skilled hands with Dhanguard as a trustworthy company setup expert. Dhanguard's knowledge and attention provide a flawless experience, whether managing legal issues, maintaining compliance with laws, or streamlining the registration procedure. By partnering with Dhanguard, businesses can confidently launch their business initiatives in Ajman, UAE, knowing that they have a dependable partner on their side every step of the way.

100% Company Ownership and 0% Corporate & Income Tax

100% Company Ownership and 0% Corporate & Income Tax

100% Company Ownership and 0% Corporate & Income Tax

Are you fed up with working for someone else? Are you tired of shifting jobs and reporting to multiple bosses? Do you want to be in command of something? Do you want to be your own boss?

Let's look at some of the reasons why you should start a business in the UAE.

The United Arab Emirates boasts the most open trade regime in the Gulf. It has been an open economy with a high per capita income and a large yearly trade surplus for the last 40 years. Companies from all over the world are relocating to the UAE and establishing offshore subsidiaries. Today, the UAE is home to a plethora of start-ups as well as multi-billion-dollar enterprises.

The emirates state is wealthy and provides solid financial situations for all businesses, resulting in a significant inflow of foreign capital in this region. As a result, the economy will be even stronger.

The UAE government intends to stimulate the economy through foreign investment. To that end, they have updated their legislative structure for foreign investors seeking to establish a business. Except for criminal law, foreign nationals are subject to an entirely different set of rules and regulations.

There is little red tape, and all legal procedures are expedited. There is little to no documentation required, and the licencing and registration process is straightforward.

The UAE government has left no stone unturned in ensuring that foreign investors have no difficulty operating their enterprises. This determination has resulted in world-class infrastructure and amenities in business parks, office buildings, warehouses, transportation, connectivity, and utilities.

It is no secret that workers, both skilled and unskilled, from all over the world, particularly India and other south-eastern countries, travel to the UAE in quest of work. As a result, business owners in the UAE do not need to be concerned about finding qualified employees to run their operations. It is a very favourable climate for both employers and employees because taxes are cheap and wages are high.

One of the most difficult aspects of starting a business in a foreign country is learning about their tax rules and manoeuvring your company so that you pay the least amount of taxes. The UAE provides a variety of business ownership patterns and tax classifications. One of them is the free zones, which have a feature of 100 percent tax exemptions. There is no company or income tax, and there is a 30% tax rebate on international film and television production spending. This means that you can keep your business profits without having to pay any business or income taxes to the government. Just make sure your businesses are registered under the free zone umbrella.

Under conventional foreign direct investment legislation, the foreign business investment is limited to 49 percent of the business, while the local partner is entitled to 51 percent. Foreign business owners in the UAE can enjoy 100 percent business ownership through various company formations.

The business environment in the UAE is regarded as one of the most favourable in the GCC region. According to the World Bank's 2015 'Doing Business' report, the UAE ranks 26th, ahead of other GCC countries such as Saudi Arabia (49th). The UAE is also ahead of European countries. The Netherlands is ranked 27th, while France and Turkey are ranked 31st and 55th, respectively. This speaks eloquently about the favourable business environment.

The World Expo 2020 is predicted to draw 25 million visitors, creating a high demand for local businesses. Expo 2020 will provide a ready-made market for a diverse range of small and medium-sized businesses specialising in the specific needs of servicing the surge of visitors. Many businesses will only gain from increased foot traffic.

Did you know that all UAE citizens are required to obtain health insurance? Famous tertiary and multi-specialty hospitals and healthcare institutes, such as the Cleveland Clinic, are located here. The UAE population has an astounding literacy rate of 92.5 percent.

The most crucial rule in the real estate sector is believed to be Location. The same is true for another type of business arrangement.

The United Arab Emirates is ideally placed between three continents: Europe, Asia, and Africa. There are over 1000 weekly flights to countries all over the world. The GCC and the broader Middle East market are easily accessible.

On the one hand, there are China and India, both of which provide raw resources and considerable commercial potential. The European Union, a major economic partner, is located on the other side of the UAE.

The following are the requirements for establishing a business in Ajman.

Finding a Sponsor is one of the most important conditions for establishing a mainland firm in Ajman. The sponsor must be a resident of the UAE. The sponsor serves as your company's service agent as well as your sleeping buddy.

A yearly sponsor charge is required of the investor. An agreement should specify and sign the sponsor's role or obligation in relation to your business.

The Sponsor issues a "No Objection certificate," which is required for the investor to begin operations.

The following step is to draught your company's Memorandum of Association. The Memorandum of Agreement (MOA) is nothing more than a set of operational instructions that your organisation must follow. The company must rigorously adhere to the following guidelines:

The Memorandum of Agreement (MOA) should be notarized by the Department of Economic Development (DED). The initial permission is granted once the MOA is notarized. For MOA notarization, you might use the services of a consultant or a lawyer.

You should now be able to find an appropriate Trade name for your organisation. The next step is to register your trade name with DED. The name should be unique and substantial enough to gain approval. If your trade name has already been chosen by another company, DED has the full right to reject it.

Following the final submission of the documents, the licencing fee can be paid at the Commercial Registration Department and the DED.

In Ajman, there are numerous commercial investment options. RESEARCH is one of the most important steps that any investor or entrepreneur should take before investing. The investor might choose between a Mainland company and a list of Free zone locales. And this decision must be made depending on the nature of the business. The Department of Economic Development (DED) is the licence issuing authority for a mainland corporation. Mainland companies are free to operate anywhere in the UAE, both within and outside of the UAE. There are no operational constraints at all.

Free zone regions are geographical areas that have been assigned or designated specifically for a specific business activity. The business is restricted to the activities or types of businesses specified by the relevant free zone authority. And the licence issuing authority is the free zone authority of each Free zone. Free zone enterprises are permitted to conduct business both within and outside of the UAE. Diversification of business to other UAE markets is not possible for Free zone enterprises.

Offshore jurisdictions are designed primarily for offshore firms that do not need a physical presence in the UAE. Offshore corporations are permitted to conduct business outside of the UAE but not within it. As a result, the investor should have a clear understanding of what to do and where to begin.

When it comes to company formation in Ajman, Mainland Companies are the most developed business entities, as they are governed by Federal Law No.2 of 2015 (the New Commercial Company Law, (NCCL)), which took effect on July 1, 2015, and replaced the previous Commercial Company Law (CCL) that was established in 1984 under Federal Law No. 8 as amended.

Mainland companies in the UAE are governed by the legal framework established by the government and must adhere to government directives. They are located within the Emirati Government's jurisdictional boundaries of commercialised geographical areas. According to mainland business incorporation law, UAE nationals must own at least 51 percent of the total stock in any commercial firm, with the exception of the following:

Before establishing a mainland company in the UAE, there are a few things to think about.

The following are some of the reasons why starting a business in Ajman Mainland is a good idea:

When it comes to the Middle East, the UAE proves to be a crucial location. It allows business investors to enter the other GCC countries and aids in the expansion of company activity.

The UAE government offers a variety of incentives to company investors, such as 100 percent foreign ownership and no personal tax, to encourage them to come forward and begin business establishment processes in a variety of industries.

Foreign investors in Ajman benefit from tax advantages. It is not necessary to pay income tax, which is an attractive feature.

Ajman offers a favourable business climate to all businesses, regardless of their size or nature, and as a result, it is the preferred place for newcomers, entrepreneurs, and established company experts.

The UAE enables business owners the opportunity to enter into double taxation agreements for import-export transactions, allowing them to avoid paying tax on both sides.

The UAE boasts a wide supply of natural resources, which have proven to be incredibly beneficial in terms of living a better lifestyle as well as in the economic realm.

The UAE offers excellent connectivity, which aids in the transportation process by providing access to roads, airports, and seaports. This freedom encourages company owners to establish their companies on the Ajman Mainland and conduct their operations there.

When it comes to the business setup process, Ajman Mainland makes it simple to get started and finish. Business owners like to speak with expert business advisors about the matter because it helps them complete the task more quickly.

When it comes to business establishments, Ajman Mainland has become a rising hub. As a result, you'll never have to worry about running a business or carrying out processes if you don't have enough office space.

Regardless of the nature of their business, Ajman Mainland enterprises have the freedom to operate throughout the UAE, as long as their actions are legal and approved by the appropriate authorities.

If you intend to start a professional firm, you should be aware that you will need to obtain a professional licence in order to conduct business. Unlike other activities, obtaining a professional licence does not necessitate the assistance of a local sponsor.

The procedure of obtaining a Visa for Ajman is stress-free. It is simple for business owners to obtain an investor visa and a residence visa if they submit all of the necessary documents.

Many businesses are hesitant to invest in the UAE since they are required to have a UAE national as a partner who owns 51 percent of the company. As a result, free zones, which enable 100 percent foreign ownership, have become a popular form of business registration in the UAE. A free zone, also known as a free trade zone, is a special tax-free zone with low trade barriers where items can be made, imported/exported, handled, or modified without paying customs duties. To maximise commercial advantages, free trade zones are typically positioned in important geographic locations such as national borders, international airports, and large seaports.

The UAE government has established a number of free zones throughout the country, each geared for a unique type of company. Non-resident corporations can take advantage of benefits such as single-window administration, no bureaucratic red tape, and 100 percent ownership in UAE free trade zones. In the United Arab Emirates, there are around 44 free zones that have drawn foreign direct investment in the form of 200,000 firms, contributing to GDP growth. The focus, setup costs, and documentation required differ each free trade zone, but the core needs are the same.

Advantages of Starting a Business in an Freezone in the UAE

There are numerous advantages to launching a business in the United Arab Emirates. However, if an investor chooses to open a firm in one of the UAE free zones, they will benefit from additional benefits. They are as follows:

The law governing commercial companies does not apply to companies established in free zones. Free Zones in the UAE are independent of the UAE's jurisdiction and are governed by laws and regulations established by the relevant free zone authority. These free zones provide a permissive working environment and simple firm formation procedures, making them an ideal business prospect for investors from all over the world. The method is straightforward and straightforward.

One of the primary reasons why global investors flock to UAE free zones for business investment is that companies registered outside of the UAE free zones cannot be owned solely by a foreign national (a maximum of 49 percent foreign ownership by the foreign national is allowed, and at least 51 percent ownership by a UAE national is required), which is one of the primary reasons why companies registered outside of the UAE free zones cannot be owned solely by a foreign national (a maximum of 49 percent foreign ownership by the foreign national is required). Apart from that, there are other advantages to establishing a business in a free zone. Free zones in the UAE are the most sought-after regions for starting a business because of the lucrative incentives and vast range of options available to investors. There are several reasons why one should start a business, as described below.

A company in the UAE free zone can engage in a wide range of business operations and get a variety of permits. The only business that UAE free zone enterprises are not permitted to engage in is insurance.

The highest level of secrecy adopted in the UAE about the identity of its owners, directors, and operations within accepted international norms protects a free zone firm.

A free zone firm is permitted to have a registered office in the free zone area in which it is licenced. Furthermore, one can open a bank account from anywhere in the world.

The most cost-effective approach to start or expand your business is to establish an offshore corporation in the United Arab Emirates. Since the introduction of offshore company creation in Ajman or the UAE in 2003, the UAE has grown to become an attractive centre for enterprises and multinational corporations (MNCs) from all over the world. Offshore companies in the UAE are well-known and well-supported by the government; they gain not only from tax and customs exemptions, but also from other financial perks. As a result, the UAE has become one of the most dynamic countries in which to locate a corporate headquarters. An offshore company creation in the UAE is one of the fastest growing in the globe and has shown to be one of the best places to start a business.

The following are the characteristics of a Ajman offshore company, a RAK offshore business, or any other offshore company in the UAE:

Offshore company registration in the UAE allows you to conduct a lucrative business while maintaining 100% control of your assets in the UAE. Aside from that, you can save money on taxes by avoiding some steps in business creation.

There are many other benefits to forming an offshore corporation in the UAE:

Profits can be realised in ways that reduce a company's overall tax liability.

By carrying out operations in the name of an offshore business, the underlying principle's identity can be kept out of documentation.

For people who desire to undertake worldwide business while also making other investments, an offshore corporation is an excellent option.

The authority may levy a percentage of the property's value when the owner sells it. This transfer cost can easily be avoided by selling the business.

Only a small percentage of property developers around the world allow multiple property owners. The number of shareholders in an offshore company in the UAE, on the other hand, might range from one to fifty, and the firm owns the property.

Many foreign and local banks in the UAE provide offshore corporate banking services.

For offshore corporations, powerful financial systems, cutting-edge telecommunications, a flexible regulatory framework, and simplified formation and filing requirements are all available.

We have a lot of experience forming new firms over the years. We are a one-stop shop for all of your business needs, from completing legal paperwork to infrastructure and promotion. We are the industry leaders in business consulting. Our goal is to provide the finest possible service to our clients and to assist them in every way possible as they start their business. Our firm provides the greatest consulting services to its clients. We follow the rules, regulations, and guidelines at all times. We make the process of forming your business simple and painless.

Our team of specialists is dedicated to providing you with the best solutions possible. We make sure you don't run into any big issues while establishing your company in Ajman.

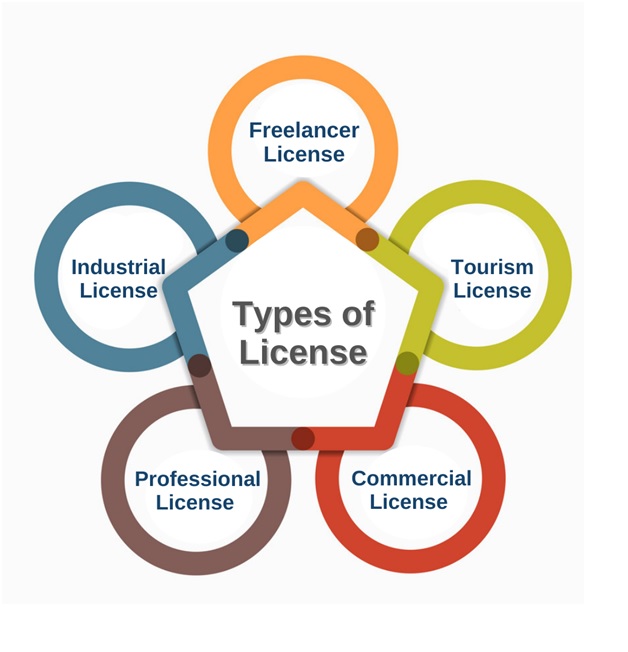

When it comes to doing business in the UAE, you'll need a trade licence. The licences are issued by the UAE economic department, and the procedures for obtaining them vary by emirate. Commercial, industrial, and professional licences are the three most common categories of licences in the UAE. However, the government also provides a number of other licences that are specialised to specific activities.

Companies that engage in any type of commercial trade activity involving goods, commodities, or services are awarded commercial licences. Before applying for a commercial licence, one must first select what activities they want to do.

Logistics, automobile rental, and real estate brokerage are just a few examples of commercial activities. The number of tertiary activities per licence, in addition to the main activity, shall be limited to ten.

In order to start an industrial or manufacturing business in the UAE, you'll need an industrial licence. With an industrial licence, entrepreneurs can assemble and process goods using local or imported raw materials.

For the manufacture of, an industrial licence is required.

Individuals and businesses are granted professional licences based on their educational qualifications to engage in a profession in which they are skilled. Artisanship, carpentry, consultation services, printing and publishing, medical services, beauty salons, computer graphic design service, repair services, security services, and document clearing are just a few of the activities covered by this licence. Foreign investors can obtain 100% ownership of their business by obtaining a professional licence.

A tourism licence is required for businesses that provide tourism services such as hotel rentals, tourist camps, cruise boat rentals, restaurants, guest houses, and travel agencies.

Agriculture licences are required for persons involved in activities such as crop cultivation and harvesting, pesticide and crop trading, greenhouse installation, and agricultural consulting.

In the United Arab Emirates, freelancing has already gained traction. Individuals can apply for Freelance Permits in the free zones of Ajman, Abu Dhabi, Ras Al Khaimah, and Fujairah.

These permits allow skilled individuals in the media, technology, art, and entertainment industries to provide consulting services in addition to their full-time jobs.

Individuals can get a Freelance Permit from places like Ajman Media City, Ajman Knowledge Park, Ajman Internet City, Ras Al Khaimah Free Zone Authority, Fujairah Creative Zone, Twofou54, and others.

The price of starting a business in Ajman might be a major deterrent for anyone considering moving their company there. Having a clear sense of how much it could cost to start a business in Ajman might make things easier for companies interested in establishing a presence in the city.

When it comes to deciding where to locate your company in Ajman, you have two options: the city's free zone area or the more desirable mainland territory. The fees will vary depending on which of the two locations you choose to operate in.

Setting up a business in the city's freezone region has its own set of benefits, especially in terms of cost. Costs, on the other hand, vary each free zone, so it all relies on which one you choose to start your business in. Aside from that, expenditures in a free zone are determined by the type of business, the nature of the facility, and the number of visas requested.

The Ajman Creative Clusters Authority (DCCA) and the Ajman Multi Commodities Centre Authority are two of the most important in Ajman (DMCC). Free zones, such as Jebel Ali Free Zone, Ajman Airport Free Zone, and Ajman Silicon Oasis Free Zone, are also available. These are the fees associated with establishing a Ajman free zone, in addition to the required minimum share capital.

Rent prices may vary based on which Free Zone you are in. The number of visas your company can obtain is determined by the space you rent. A Smart Desk, office space, or a permanent office are all options. A service charge that is calculated as a percentage of your lease may be included.

This cost is imposed on trade firms, service firms, and industrial firms. The licence is issued by the chosen Free Zone.

This fee is paid to the Free Zone Authority in order for you to register your business. The price varies depending on the Free Zone and the type of company, such as a Free Zone Establishment (FZE) or a Branch Company.

According to the amount of office space available in the Free Zone, a certain number of visas are authorised. Visa fees may differ depending on whether employees are from outside or within the UAE.

Each Free Zone business must show that it has a certain level of bank guarantee for its employees. For example, this could be a 45-day wage with a one-way ticket back to their home country.

The cost of establishing a business on the mainland, like that of a free zone, is determined by criteria such as the nature of the enterprise, the number of visa permits required, and the location.

We've compiled a breakdown of the costs associated with forming a company in Ajman's Mainland. Keep in mind that the cost of business setup in Ajman stated above is an estimate and may vary depending on a variety of factors such as the type of organisation, business type, location, and business requirements. There are also some additional expenses that pile up over time.

The cost listed below is for the formation of a Limited Liability Company (LLC), which is the most popular corporate entity in the UAE.

You can receive an immediate licence from the Department of Economic Development to start doing business in Ajman (DED). It enables you to start operating your business right immediately. The cost of a licence in Ajman Mainland varies depending on the type of licence.

You'll need permission to use the name you've chosen for your business. Depending on the name, the price may vary slightly. There are a variety of fees to pay for this, including reservation fees, commercial name fees, foreign company name fees, and so on.

In order to start a business, you must have an office space. This is just to ensure that the business is lawful, as it permits authorities to conduct inspections, supervise activities, and verify that immigration regulations are being followed.

The MOA is negotiated with the company's partners or owners. The cost of attestation varies based on the amount of share capital contributed.

An LLC's contract is drafted with the agreement of all parties involved. Because the contract must be written in both Arabic and English, there may be an additional price for translation. At the court, all partners or their lawyers must sign the Court Agreement Attestation.

To perform commercial activities, this charge shall be paid once a year.

The cost of a Ajman trade licence varies depending on the nature of your firm. It's also possible that you'll be asked to show proof of a security deposit.

A general trade company's cost may differ from a manufacturing or industrial companies.

Administrative Expenses and the Public Trash Municipality Charge Administrative costs are paid for the department's essential paperwork, and the public garbage fee is paid for the public waste.

On the total amount of rent, a portion of this is paid to the government. An office or shop will provide you 5%, while a warehouse will give you 20%.

The following is a breakdown of the costs of forming an offshore business in Ajman.

An offshore firm is a versatile tool for conducting commercial activity and making investments. Some offshore jurisdictions, on the other hand, may have a requirement for standard share capital, while others do not.

The cost of forming an offshore business is paid on an annual basis. The registration fee is determined by the offshore jurisdiction chosen by the company's owner as well as the sort of business activity to be conducted.

In order to form an offshore corporation in Ajman, you must have a local presence. However, having a fully operational office that is exposed to business activities is not required. However, a registered address is required. This is a once-a-year cost.

In order to conduct business in the UAE, you must have a bank account. This is a one-time, one-time investment.

During the absence of the owner, directors, shareholders, or associated nominees are appointed to make decisions and sign documents. The owner gives the candidates limited rights and charges for their services.

A maintenance charge is paid to the offshore region's jurisdiction authority. For the first legal year, there is an annual charge; after that, a fixed sum is paid to the offshore body.

Ajman is set to become a major financial and economic hub in the Middle East. As a result, a number of businesses and entrepreneurs have chosen to locate their offices here. Because owning a home is not always possible, renting an office in Ajman is a popular option. The obvious advantage is that it eliminates the trouble of physically owning and managing office space. In reality, rental offices and co-working spaces are becoming the go-to business centres in not only Ajman, but all of the world's major cities.

A physical presence in the form of an office is required for businesses operating in Ajman or the rest of the UAE. If one desires to rent it, specific procedures must be undertaken as well as licences and approvals sought.

If you opt to rent an office space in the Emirate, you will be required to pay a deposit. As a result, you take the office off the market until the lease agreements are ready. The documentation required to complete the rent agreement are prepared by a real estate agent. Any contractual provisions that are being negotiated should be settled before the two parties sign the final leasing agreement.

Dhanguard can help you find a rental office in Ajman for your business. The following are some of the services we offer: